- Eligibility: Microenterprises operating for at least one year and no existing loans over ₱100,000.

- Loan amount and terms: Up to ₱300,000, repayable over three years with a 12-month grace period and an annual interest rate of 12% on the diminishing balance.

- Eligibility: SME owner who has positive net income in the last year. Prioritizes first-time borrowers.

- Loan amount and terms: Up to ₱20,000,000 collateral-based or up to ₱5,000,000 collateral-free loans, repayable over three years with a 12-month grace period, at an annual interest rate of 12% on the diminishing balance.

- Eligibility: MSMEs with BIR-filed Financial Statements (for loans exceeding ₱3,000,000) and prior borrowers from SB Corp.

- Loan amount and terms: Up to ₱20,000,000 with collateral or ₱5,000,000 collateral-free, repayable over five years with a 12-month grace period, at an annual interest rate of 8% to 12% on the diminishing balance.

DTI loans for MSMEs provide financial assistance tailored to different small businesses, with some programs prioritizing specific industries or groups, like tourism or agriculture, receiving additional funding.

DTI Loan Application: Requirements, Steps, and Tips

Securing a DTI loan is an exciting and potentially transformative move for your business. Here are a few steps to ensure a smooth application process.

1. Research and preparation

Before applying, take time to understand the specific DTI program you’re interested in. These programs serve diverse business needs and come with specific eligibility criteria. For example, if you’re looking to manage cash flows, a smaller loan like the P3 might be better suited than a larger one like the MSME Multi-Purpose Suki Loan.

Evaluate your options carefully and choose the one that best aligns with your goals. Also, you should have a well-prepared business plan, even a laundry business franchise needs one, that clearly outlines how you intend to use the loan funds.

You can consult DTI’s Negosyo Center for guidance on selecting the most suitable loan program and crafting your business plan.

2. Online registration

Start the process by registering online through the SB Corp Borrower Registration System (BRS) website. Be meticulous when filling out the necessary forms, ensuring all details are accurate and up-to-date. This website is your digital gateway for managing your DTI loan.

To avoid delays, it would be best to have all your DTI loan application requirements, information, and documents ready before you begin. Don’t be afraid to open the form to see what you may be missing; always double-check your data for accuracy.

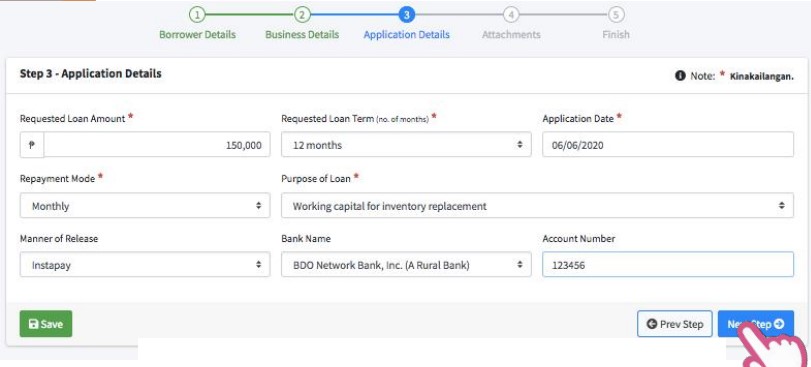

Here’s a filled-in version of the 3 rd page of the form for your reference:

3. Complete application form

The application form is the most critical requirement for a DTI loan. Ensure you provide comprehensive and accurate business information, including your business name, registration details, and chosen loan program.

While there might be a temptation to exaggerate some details to present your business in a better light, you must remember that honesty is always the best policy.

Remember to review all information thoroughly before submissions. Take your time to fill out the form, and don’t be afraid to seek assistance if needed. Accuracy is more important than speed, as errors could lead to delays or rejection.

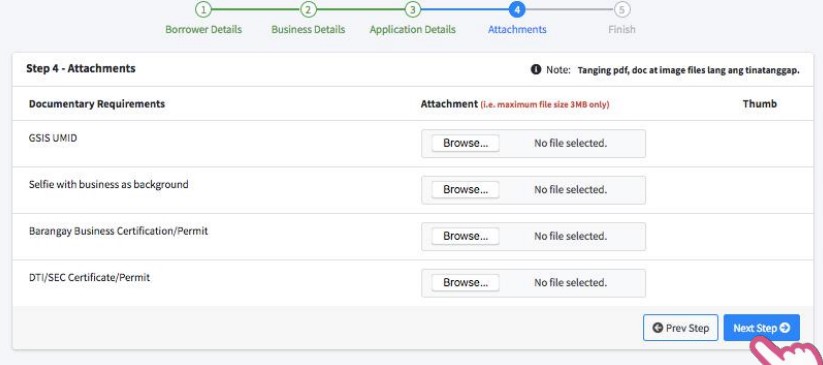

4. Upload all required documents

DTI loans typically require specific documents to support your application, such as business or barangay permits, financial statements, and project proposals. You should organize your documents neatly and upload them according to the provided guidelines, keeping in mind that the maximum file size per upload is 3 MB.

Here’s a picture of the uploading step for your reference:

5. Submission and confirmation

After completing the application form and uploading the necessary documents, submit your application. You should receive a confirmation indicating that they’ve received your application. Be patient, as DTI may require time to review your submission.

Stay vigilant for any updates or inquiries from the agency. Check your email and be prepared to provide additional information if requested.

Fuel Your Small Business Dreams through DTI Loans

In your efforts for financial support and business growth, DTI loans are a beacon for small businesses in the Philippines. Their low-interest rates, minimal collateral requirements, and efficient application process can be the catalyst for achieving your venture goals. But that does not stop there, as you need to be informed on business loan trends for your business to success

As you contemplate your next move, don’t hesitate to reach out to the experts at Zenith Capital. We specialize in online lending in the Philippines, providing tailored business loan solutions, like manufacturing business loan, to propel your venture to new heights. Take that crucial step towards financial empowerment today by applying now!

Rizza Templonuevo is not just an accomplished finance professional and business leader, but also a loving wife and a dedicated mother of two. With a passion for helping businesses grow and thrive, she brings her extensive knowledge and expertise as Vice President of Zenith Capital Credit Group Corporation to help countless SMEs and corporations across the Philippines access the financing they need to succeed.

When she’s not busy with work, Rizza enjoys immersing herself in the worlds of fashion and social events, as well as traveling to new and exciting places.

Tags: Business Loan, DTI, DTI LoansAdd a Comment Cancel reply

Recent Posts

- Zenith Capital Ranks 14th in Philippines’ Top 30 Growth Companies

- Corporate Credit Cards 101: How to Use Them for Your Business

- 5 Marketing Strategies for Small Businesses in the Philippines

- BPI Business Loans: How They Work and How to Apply

- A Guide on How to Start a Travel and Tour Agency Franchise in the Philippines

Recent Comments

- бнанс реферальний код on Top 6 Industries That Benefit from Business Loans

- creación de cuenta en Binance on 5 Ways to Manage Cash Flow Effectively with a Capital Loan

- youtube to mp3 320 on 5 Profitable Small Business Ideas in the Philippines

- Pumarehistro on A Guide on How to Make a Solid Business Plan to Secure a Loan

- webech on A Guide on How to Start a Travel and Tour Agency Franchise in the Philippines

Archives

Categories

- Business Guide

- Business Loans

- Uncategorized

Zenith Capital is a financing

company that facilitates quick and

easy-to-access business loans to

Philippine SMEs and corporations.

QUICK LINKS

CONTACT

- +63 8 636 5458

- info@zenithgroup.com.ph

SALES

- SMART +63 969 590 7070

ZCap Agents

- SMART +63 919 084 6104

LOCATION ON MAP

- Unit 2701, One World Place, 32nd Street, Bonifacio Global City, 1631 Taguig City, Philippines

We are using cookies to give you the best experience on our website.

You can find out more about which cookies we are using or switch them off in settings .

Accept Settings Close GDPR Cookie Settings![]()

- Privacy Overview

- Strictly Necessary Cookies

At http://zenithcapital.com/, accessible from http://zenithcapital.com/, one of our main priorities is the privacy of our visitors. This Privacy Policy document contains types of information that is collected and recorded by http://zenithcapital.com/ and how we use it.

If you have additional questions or require more information about our Privacy Policy, do not hesitate to contact us.

This Privacy Policy applies only to our online activities and is valid for visitors to our website with regards to the information that they shared and/or collect in http://zenithcapital.com/. This policy is not applicable to any information collected offline or via channels other than this website.

Consent

By using our website, you hereby consent to our Privacy Policy and agree to its terms.

Information we collect

The personal information that you are asked to provide, and the reasons why you are asked to provide it, will be made clear to you at the point we ask you to provide your personal information.

If you contact us directly, we may receive additional information about you such as your name, email address, phone number, the contents of the message and/or attachments you may send us, and any other information you may choose to provide.

When you register for an Account, we may ask for your contact information, including items such as name, company name, address, email address, and telephone number.

How we use your information

We use the information we collect in various ways, including to:

- Provide, operate, and maintain our website

- Improve, personalize, and expand our website

- Understand and analyze how you use our website

- Develop new products, services, features, and functionality

- Communicate with you, either directly or through one of our partners, including for customer service, to provide you with updates and other information relating to the website, and for marketing and promotional purposes

- Send you emails

- Find and prevent fraud

Log Files

http://zenithcapital.com/ follows a standard procedure of using log files. These files log visitors when they visit websites. All hosting companies do this and a part of hosting services' analytics. The information collected by log files include internet protocol (IP) addresses, browser type, Internet Service Provider (ISP), date and time stamp, referring/exit pages, and possibly the number of clicks. These are not linked to any information that is personally identifiable. The purpose of the information is for analyzing trends, administering the site, tracking users' movement on the website, and gathering demographic information.

Cookies and Web Beacons

Like any other website, http://zenithcapital.com/ uses "cookies". These cookies are used to store information including visitors' preferences, and the pages on the website that the visitor accessed or visited. The information is used to optimize the users' experience by customizing our web page content based on visitors' browser type and/or other information.

Advertising Partners Privacy Policies

You may consult this list to find the Privacy Policy for each of the advertising partners of http://zenithcapital.com/.

Third-party ad servers or ad networks uses technologies like cookies, JavaScript, or Web Beacons that are used in their respective advertisements and links that appear on http://zenithcapital.com/, which are sent directly to users' browser. They automatically receive your IP address when this occurs. These technologies are used to measure the effectiveness of their advertising campaigns and/or to personalize the advertising content that you see on websites that you visit.

Note that http://zenithcapital.com/ has no access to or control over these cookies that are used by third-party advertisers.

Third Party Privacy Policies

http://zenithcapital.com/'s Privacy Policy does not apply to other advertisers or websites. Thus, we are advising you to consult the respective Privacy Policies of these third-party ad servers for more detailed information. It may include their practices and instructions about how to opt-out of certain options.

You can choose to disable cookies through your individual browser options. To know more detailed information about cookie management with specific web browsers, it can be found at the browsers' respective websites.

CCPA Privacy Rights (Do Not Sell My Personal Information)

Under the CCPA, among other rights, California consumers have the right to:

Request that a business that collects a consumer's personal data disclose the categories and specific pieces of personal data that a business has collected about consumers.

Request that a business delete any personal data about the consumer that a business has collected.

Request that a business that sells a consumer's personal data, not sell the consumer's personal data.

If you make a request, we have one month to respond to you. If you would like to exercise any of these rights, please contact us.

GDPR Data Protection Rights

We would like to make sure you are fully aware of all of your data protection rights. Every user is entitled to the following:

The right to access – You have the right to request copies of your personal data. We may charge you a small fee for this service.

The right to rectification – You have the right to request that we correct any information you believe is inaccurate. You also have the right to request that we complete the information you believe is incomplete.

The right to erasure – You have the right to request that we erase your personal data, under certain conditions.

The right to restrict processing – You have the right to request that we restrict the processing of your personal data, under certain conditions.

The right to object to processing – You have the right to object to our processing of your personal data, under certain conditions.

The right to data portability – You have the right to request that we transfer the data that we have collected to another organization, or directly to you, under certain conditions.

If you make a request, we have one month to respond to you. If you would like to exercise any of these rights, please contact us.

Children's Information

Another part of our priority is adding protection for children while using the internet. We encourage parents and guardians to observe, participate in, and/or monitor and guide their online activity.

http://zenithcapital.com/ does not knowingly collect any Personal Identifiable Information from children under the age of 13. If you think that your child provided this kind of information on our website, we strongly encourage you to contact us immediately and we will do our best efforts to promptly remove such information from our records.

Changes to This Privacy Policy

We may update our Privacy Policy from time to time. Thus, we advise you to review this page periodically for any changes. We will notify you of any changes by posting the new Privacy Policy on this page. These changes are effective immediately, after they are posted on this page.

Our Privacy Policy was created with the help of the Privacy Policy Generator.

Contact Us

If you have any questions or suggestions about our Privacy Policy, do not hesitate to contact us.

Strictly Necessary CookiesStrictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

Enable or Disable CookiesIf you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.